Stephen McDowell

In the past year prices have been rising rapidly for many items, including lumber, cars, gas, appliances, and homes. What is causing this? Some politicians have claimed it is pent up demand brought on by the COVID crisis that has kept people from spending. Others say the inability for producers to operate at full capacity has led to a shortage of various products which has pushed up prices. While these factors may be having some effect, the recent satirical article by Babylon Bee more clearly reveals the cause: “Biden Proposes $2 Trillion Bill to Study What’s Causing Inflation Rates to Rise.”

The primary reason that prices are increasing is trillions of dollars of deficit spending. It is not just President Biden and the current Democratic Party leadership who are to blame because annual deficit spending by the national government has been going on for over one-half a century no matter which party is in control (although Democrats are especially good at spending more money than is received via taxes).

Faced with the unknown impact of the COVID virus, the federal and state governments in the United States shut down much of the economy during the past year. To assist those without income, President Trump and the Republicans passed a massive relief bill which required more deficit spending than usual. When Biden assumed the presidency and the Democrats took control of the House and Senate they passed even larger relief bills (and they are proposing more massive spending bills). These huge deficits require, in essence, the creation of new money. Increasing the money supply in a nation causes inflation; it causes the rise in prices.

Inflation is not the result of rising prices. Rather, inflation is caused by falsely increasing the money supply. This is done by ignorant (and often corrupt) government leaders. It is a violation of God’s law.

When people or nations violate God’s principles there are negative consequences. His principles relate to all of life, including money. A biblical economy will have an honest money system. Leviticus 19:35-37 states:

You shall do no wrong in judgment, in measurement of weight, or capacity. You shall have just balances, just weights, a just ephah, and a just hin: I am the Lord your God, who brought you out from the land of Egypt. You shall thus observe all My statutes, and all My ordinances, and do them: I am the Lord.

One sign of a nation rejecting God or backsliding from following God[i] is the condition of its currency and the degree of honesty in its weights and measures. In rebuking Israel from turning from God, Isaiah points out how “your silver has become dross” (Isa. 1:22).

To many people today, inflation means an increase in prices. This, however, is simply the symptom of the national government increasing the money supply to pay for budget deficits. When the money supply is increased, either through printing more money, credit-expansion, or borrowing from a central bank, the purchasing power of each dollar falls, and businesses must increase the prices they charge to keep up with their own higher costs.

In other words, the value of money, like other commodities, is determined by supply and demand. When the supply of money is relatively constant, the purchasing power of money will be relatively stable. As the supply rapidly increases compared to the supply of goods and services, its value declines; that is, more money is needed to buy the same product, and prices rise.

Politicians place the blame on others such as greedy businesses, big corporations, foreign governments, or calamitous events. But persistent inflation (which we have had for the past century or so, with periods of variable levels) has one source: rapid growth in the money supply. Comparing the growth of the money supply in various nations during the past decades reveals the greater the annual growth rate of the money supply, the greater the annual growth of rate of inflation.[ii]

| Growth of Money Supply and Inflation, 1990-2007[iii] | ||

| Annual Growth Rate of the Money Supply (%) | Average Annual Growth Rate of Inflation (%) | |

| United States | 2.1 | 2.8 |

| Singapore | 2.5 | 1.4 |

| Sweden | 4.0 | 2.0 |

| Canada | 5.1 | 2.1 |

| Peru | 22.7 | 21.9 |

| Ghana | 24.8 | 22.2 |

| Nigeria | 27.5 | 21.9 |

| Romania | 35.6 | 61.7 |

| Turkey | 71.8 | 51.6 |

| Ukraine | 84.5 | 89.9 |

| Zimbabwe | 164.8 | 165.3 |

| Congo, Dem. Republic | 140.3 | 360.4 |

The only one to benefit from inflation is the government because it is the first one to spend the money. It is a hidden form of tyrannical taxation because as the government spends more and more money created from thin air, the purchasing power of the citizen’s bank account goes down and down. Inflation is theft. Remember, the Bible declares, “thou shalt not steal” (Ex. 20:15).

If a private citizen decides to set up a printing press and make some money, he is called a criminal (counterfeiting); if the government does the same thing it is called “monetizing the debt” or “stimulating the economy.” What is the difference?

Inflation discourages savings by promoting a “spend now” attitude. It encourages debt, deceives people about pay increases and future wealth accumulations, is a hidden theft tax, and decreases capital available for investment.

Inflation is a result of an increase in the money supply. Most inflation is due to bad or corrupt government officials who create dishonest money so they can spend more without directly taxing the people. There have been examples of localized inflation where honest money has rapidly increased due to finding large reserves of gold or silver, such as in California (1848 and following) and Alaska (1896-1902), but most cases are the result of bad government leaders.[iv]

Recessions or Depressions follow Inflation

If the government keeps printing money with abandon, the result is runaway inflation. Prices rise every day (or even in a few hours). This occurred during the American Revolution, in France in the late 1790s, in Germany in 1923, in Brazil in 1971, in Russia in the 1990s, and at various other times.

Runaway inflation is quite dramatic. For example, a pound of butter in Germany in 1914 cost 1.4 marks. By 1918 it cost 3.0 marks; in 1922 it was 2400 marks and in 1923 a pound of butter cost 6,000,000,000,000 marks! In the Hungarian inflation of 1946, money lost all its value. It was cheaper to wallpaper a room with money than with wall paper.[v] People used wheelbarrows to carry their money when they went shopping.

Children playing with bricks of money in Germany, where inflation reduced the value of currency to nearly nothing.

Once inflation starts it is very difficult to stop, and then with only great economic pains. When more money becomes available, demand for new and more expensive products rises since people have more money to buy things. Production and sales increase which leads to hiring more employees. New plants are built and larger stores are opened. But prices also begin to rise. The government who creates the money does not want runaway inflation to occur, so they cut back on the money supply. Now people do not have enough money to buy more expensive or non-necessary items. They quit buying these things. The smaller demand causes the producers to fire employees and downsize. Unemployment rises, producers must readjust their businesses to the new conditions, and people cannot make money. A depression occurs. Bad decisions by businesses are made evident.

A depression is a correction period that follows inflation. It occurs when the government decreases the money supply or slows down its increase. Since governments do not want depressions to occur, they try to balance how rapidly they increase the money supply with the amount of unemployment. A recession is a less dramatic adjustment to inflation. It is a mild depression.

As long as governments determine the money supply there will be periods of inflation then recession (with possible depression intermixed). Politicians inflate the money supply which leads to rising prices. To attempt to stop rising prices, they deflate the money supply, which leads to higher unemployment. They then start inflating again. This is what is called the business cycle.[vi] While it is often presented as the natural outcome of the free market, it is really the product of dishonest government intervention in money and banking in a nation. The severity of a recession depends upon how much inflation is slowed. Severe adjustments result in boom and bust cycles.

Specific businesses can have booms and busts based upon factors besides the money supply, including such things as supply and demand, changing technology, and competition. Businesses must regularly adjust to what people need and want, and how much they are willing to spend for things. But in periods of inflation, bad decisions and investments by businesses (and individuals) are not as quickly evident. In recessions or depressions these bad decisions will require dramatic adjustments, with some businesses failing.

During WWI and the 1920s the government created much new money. This is what mainly caused the “Roaring Twenties.” The inflation caused the stock prices to skyrocket. Many people had more money to invest in the market. People felt rich. They spent money fast. (Velocity, how fast people spend money, affects prices as well.) In the 1930s government stopped expanding the money supply and people also stopped spending money so fast. A depression occurred. The action of the government did not get us out of the depression. It actually extended the depression. Government actions included restricting trade, increasing spending, and increasing taxes. The present Congress and administration appear to be following much of the same path.

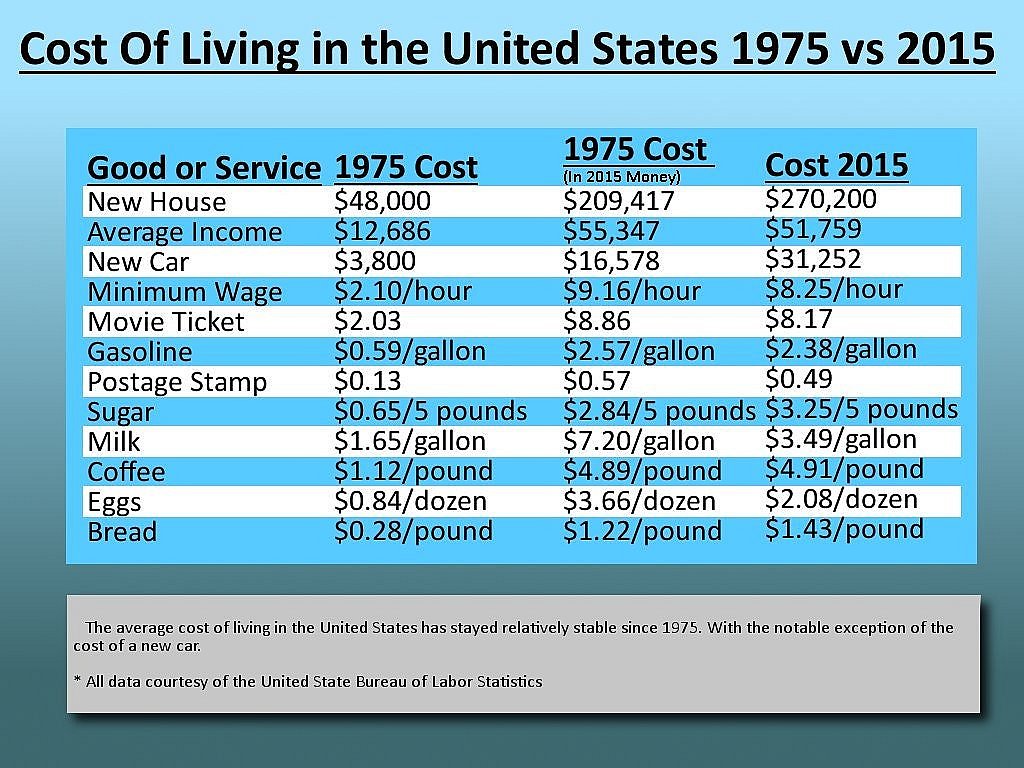

Large rise of prices during the past 50 years are an indication of the government regularly increasing the money supply. The people who are harmed the most from inflation are those living on fixed incomes or who have retired and are relying on social security and money saved over their working lives.

An example of bad decisions made due to inflation became evident in 2008. With easy credit available and low interest rates (the money supply increased greatly in early 2000s), many people bought houses at inflated prices. Some were doing this to attempt to make money, some moved into larger homes, and others bought homes for the first time. When the economy slowed (stocks dropped, spending decreased, unemployment rose) home prices dropped. Many people who lost their jobs could not meet the payments and had their homes foreclosed. Since the value of their homes had declined they could not sell them to pay off their mortgage.

Price Controls

When prices start rising due to increased money supply, why doesn’t the government just step in and pass laws mandating no price increases? If this happens, then producers will have to lessen the quality (or diminish quantity) of their product to still make money. What if government mandates the same high quality? Then producers will go out of business if they cannot make money, or else they will sell their goods in the underground free market, or black market (or alternate zones of supply). The result will be a shortage of goods.

To End Inflation

Inflation must stop permanently if the economy is to be established on a sound, long-term basis. To get rid of inflation we should abolish the central bank, repeal all tender laws, and return to a gold warehouse receipt standard (or more specifically, allow the free market to determine what will be used as money for buying and selling — this could be gold, but also silver, or anything that meets the characteristics of honest money). In addition, we must end fractional reserve banking.[vii]

With our current monetary system, returning to an honest money system is doubtful. Therefore, to keep inflation in check, we should require by law that the money supply cannot be increased more than 1-2% or so per year, which in part will require ending deficit spending.

Remember, inflation is an ethics problem. It occurs when dishonest politicians promise people many “free” things and the people gladly accept these things that someone else must pay for. (Someone must pay for it, for there is no such thing as a free lunch.) Dishonest money reflects dishonest leaders and dishonest citizens. The quality of the money of a society reflects the quality of the character of the people.

[i] America was birthed as a Christian nation; that is, she was founded upon biblical principles. In recent times she has been rejecting God and His truth in many ways, including rejecting biblical economic principles.

[ii] See James D. Gwartney, Richard L. Stroup, Dwight R. Lee, and Tawni H. Ferrarini, Common Sense Economics, New York: St. Martin’s Press, 2010, p. 68.

[iii] Gwartney et al, Common Sense Economics, p. 68.

[iv] When the Spanish conquistadors stole large amounts of gold from the Aztecs and Incas in the 1500s and 1600s and brought this to Europe, this increased the money supply enough to cause prices and wages to rise. This leveled off when the new gold and silver ran out.

[v] Richard J. Maybury, Whatever Happened to Penny Candy? Placerville, Cal.: Bluestocking Press, 2004, 26.

[vi] Ibid., p. 54.

[vii] See Stephen McDowell, Honest Money and Banking, Charlottesville: Providence Foundation, 2009.